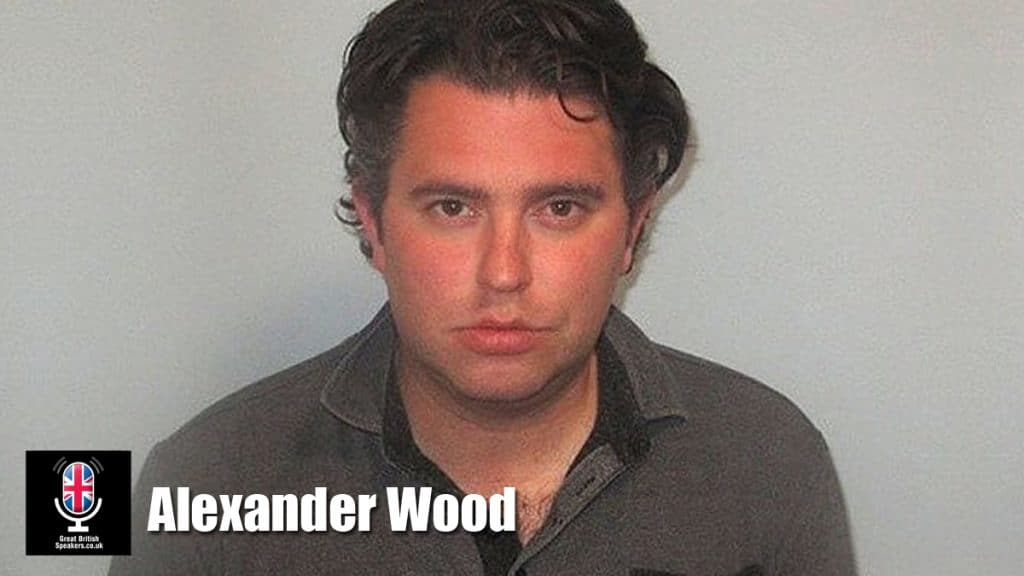

Alexander Wood

Alexander Wood’s journey has taken him from the heights of the classical music world to the depths of criminal life and on to a respected role in the Counter Fraud profession.

His early life was defined by his prodigious talent as a violin soloist. From the age of 13, he performed under some of the world’s most renowned conductors. He was awarded prestigious scholarships to attend elite institutions like the Purcell School, the Royal Academy of Music, and the Royal College of Music, garnering numerous accolades.

He was even a regular guest at Buckingham Palace and Windsor Castle.

However, at the age of 24, Alexander Woods’s promising music career came to an abrupt end. With mounting debts and no source of income, he turned to a life of crime. His descent into criminal activity spiralled, leading to years spent in prison for various offences, ranging from impersonating aristocracy to masterminding multi-million-pound cybercrimes.

Since his release in early 2022, Alexander Wood has dramatically transformed his life, becoming a leading figure in the fight against fraud. His expertise is now in high demand across both public and private sectors, where he offers unique insights into the mindset of a criminal. In recognition of his work, Alexander has been nominated for the 2024 Public Sector Fraud Awards in two categories: Newcomer of the Year and Outstanding Contribution.

He is a respected keynote speaker, and his speeches, such as Inside the Mind of a Criminal, provide invaluable insight into topics like social engineering and underworld banking.

Contact Great British Speakers to book Alexander Wood, a former convicted criminal and reformed counter fraud expert and speaker, for your next event.

Type Of Speaker

More About Alexander Wood

AlexanderWood’s influence extends beyond public sector events; he advises leading global financial institutions, including Tier 1 banks, insurance providers, and legal firms. His consultations focus on understanding the“Fraud Mindset” and the sophisticated techniques used by fraudsters, and his clients include notable companies like Experian PLC.

Alexander is working on a national initiative with financial institutions, law enforcement, and government bodies to educate young people about the dangers of involvement in mule activity.

While incarcerated, Alexander’s story captured the attention of world-leading literary agent Andrew Lownie. His life is now being chronicled in a major documentary currently in production by acclaimed filmmakers Chris Atkins and Louis Theroux of Mindhouse Productions.

Alexander Wood | Keynote Speaker

Since leaving prison in 2022, Alexander Wood has earned the respect of the Counterfraud industry and established himself as a noteworthy speaker.

Alex’s story is captivating and compelling, offering audiences a rare insight into the workings of the criminal mind. Driven by a genuine desire to make amends for his past, Alex is dedicated to raising awareness about the dangers of fraud. His mission extends beyond personal redemption, as he actively campaigns to protect future generations from the risks associated with criminal activity.

In February 2023, Alexander Wood was a Keynote Speaker at CounterFraud 2023, organised by the Cabinet Office, GovNet, and the Public Sector Fraud Authority. Following this, he spoke at several other prominent events, including the London Boroughs’ Fraud Investigators’ Group (LBFIG) AGM, the National Investigations Conference (NICONF23), and the LA Financial Investigators Forum.

In addition to public sector speaking and advisory, he delivers speeches and consults to leading global financial institutions (including Tier 1 banks, insurance providers, law firms, and risk experts such as Experian PLC) to enable a deep understanding of the ‘Fraud Mindset’ and sophisticated ‘Social Engineering’ techniques.

Alexander Wood | Speaking Topics

From His Majesty’s Palaces to Her Majesty’s Prisons

What leads someone down the path of becoming a fraudster? In this speech Alexander Wood talks about his early years and what led him from a law-abiding life to committing increasingly serious financial crimes. Alexander discusses his flawed decision-making processes and speaks candidly about how he laundered the proceeds of his offences providing vital insights into how financial institutions can fight back. Alexander offers also important insights into how criminal gangs are using AI to automate financial crime, with devastating effect, and offers advice on how this can be combatted.

Combatting Fraud by Eliminating Mule Accounts: How can we Detect and Close Mule Accounts prior to a Fraudulent Event?

In this talk Alexander Wood starts with the basics, explaining what a Mule Account is and how they can become a central piece of a fraudster’s toolkit. People who relinquish control of accounts are almost always vulnerable in some way and are being cruelly exploited by criminals. Alexander helps clients understand how the accounts are taken over and how financial organisations can learn to detect such accounts prior to them receiving the proceeds of crime.

Future Threats for Generative AI: An Opportunity for Bad Actors?

Depending on who you ask, Artificial Intelligence is either a force for good or for evil. Financial institutions can use Generative AI to fight against fraudsters but only if they fully understand exactly how criminals are utilising AI to automate financial crime and execute ‘zero touch’ fraud, including by using Deepfake clones. In this talk, Alex Wood offers insights into how criminals are utilising AI for their means and how financial institutions can combat it.

Underworld Banking: What is the Cross-Border threat posed by Hawala and Daigou?

In an increasingly cashless society, a fraudster’s ability to properly launder money into digital and purportedly legitimate assets is imperative. In this talk, Alexander Wood explains how underground banking networks such as Hawala and Daigou enable the immediate global dissipation of assets, and the potentially devastating consequences it can bring (such as the inadvertent funding of terrorism) and how these networks also allow for the purportedly legitimate accumulation of high-value assets back in the UK.

Deep Social Engineering: I am not the Duke of Marlborough and nor am I calling from your Bank!

The Counter Fraud Profession must have a strong understanding of how fraudsters deploy social engineering to perpetrate their offences. Whether by impersonating others (perhaps royalty, police or bank staff) or gently and subtly manipulating conversations to build false trust with a victim (as we often see in romance fraud). We can protect and prevent by educating the public on these heartless techniques.

Inside the Mind of a Criminal: From the Fraud Mindset to the Psychopathy Spectrum.

A fraudster’s actions have often been considered by reference to the Fraud Triangle (incentive, opportunity, rationalisation). However, in modern society, the Fraud Triangle is outdated and unhelpful. In this, Alexander Wood draws on his own lived experience to explain how fraud is now being fuelled by bad actors who show traits of psychopathy and religious ideology, amongst other things.

Call +44 1753 439 289 or email Great British Speakers now to book Alexander Wood, former violin soloist, convicted criminal, and reformed Counter fraud expert, for your corporate event.

Contact us.

Get In Touch